Zigbang – Virtual Real Estate Platform Shakes Foundations of Property in South Korea

When looking for a home in South Korea, you could find it in a snap with Zigbang. It is a pioneering online real estate platform founded in 2012 by Jason Ahn, whose diverse background spans statistics, accounting, gaming, and venture capital.

Originally named ‘Channel Breeze,’ the company rebranded as Zigbang. The snappy name is a combination of the Korean words 직 (jig), meaning “to take a photo,” and 방 (bang), meaning “room.” This symbolizes its mission to redefine the residential experience through advanced technology. But can Zigbang upset – or even compete with – the traditional real estate values of South Korea?

What is Zigbang?

Zigbang offers one of the country’s most comprehensive property databases, listing rental apartments, studios, and shared housing throughout South Korea. Furthermore, the platform facilitates direct connections between users and property owners or agents, streamlining the traditionally complex rental process.

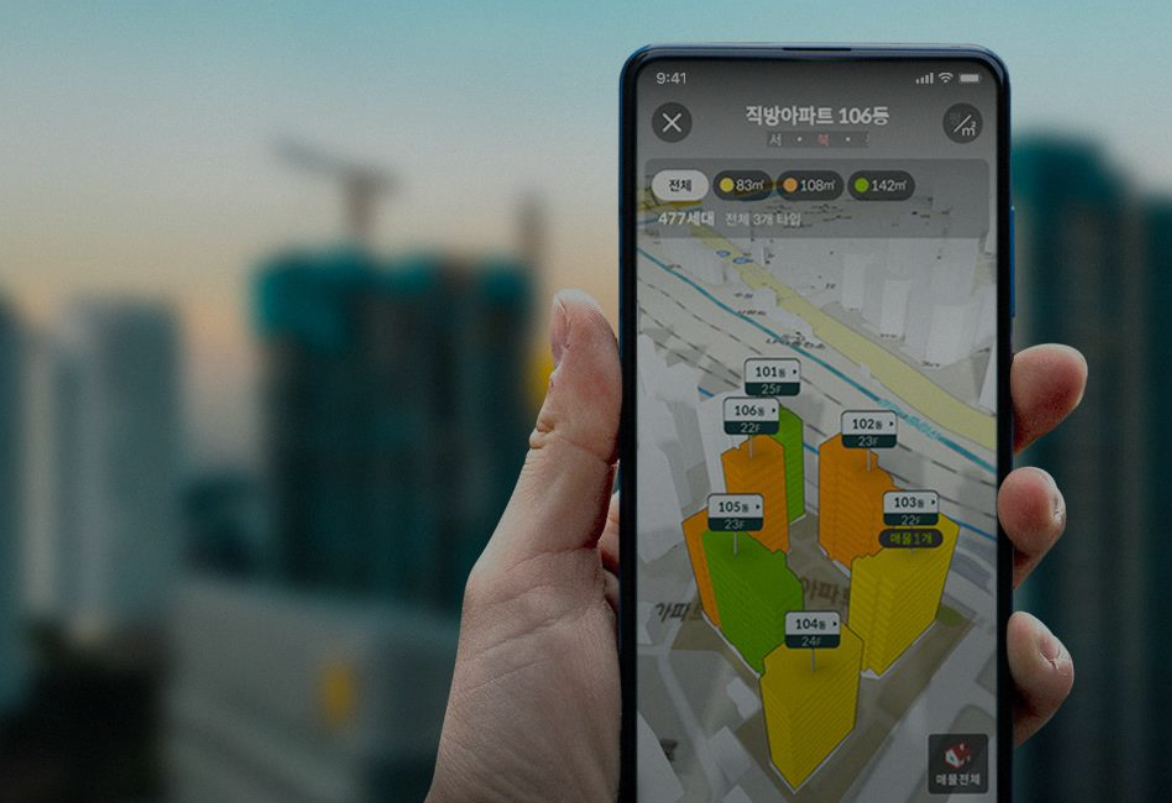

Known for its user-friendly interface, Zigbang empowers users to filter search results by location, price, and property type, coupled with market insights to inform decisions. A standout feature is virtual property tours, allowing users to explore homes remotely, which has become increasingly valuable.

Zigbang’s business model predominantly involves charging listing fees to landlords and agents. Furthermore, additional premium services such as professional photography and advanced virtual tours provide added revenue streams.

Rooms in a Snap: Early Days and Funding

Starting in June 2011 with seed funding of KRW 3 billion, Zigbang faced the critical early challenge of building trust with landlords and gathering a competitive catalogue of property listings. To overcome this, they developed scripts to obtain photo permissions efficiently, eventually amassing pictures of around 150,000 properties that underpinned their database.

Early Growth

Focusing strategically on mobile accessibility, Zigbang targeted one- and two-room listings favored by young renters initially. By 2016, the app had achieved 12 million downloads and enlisted 7,000 member realtors nationwide, demonstrating rapid market adoption.

In 2015, a Goldman Sachs-led consortium invested KRW 38 billion (approximately $33 million), validating the emerging real estate tech sector’s potential within Korea’s e-commerce ecosystem.

In October 2017, Zigbang introduced VR home tours, therefore differentiating itself in a competitive landscape by providing immersive property viewing experiences.

Zigbang expanded its data capabilities by acquiring Hogangnono in 2018 and entering consignment management agreements with platforms like Daum Real Estate. Collaborations with institutional investors including KORAMCO and REITs strengthened its market foothold.

Key Milestones

- 2012: Launched mobile app

- 2015: Surpassed 20 million downloads

- 2017: Market leader with 20 million downloads

- 2022: Acquired Samsung SDS’s Home IoT division, venturing into smart home technology

- May 2022: Launched Soma, a virtual office platform supporting 12 languages

- 2023: Expanded into Saudi Arabia, engaging in digitizing real estate and participating in the NEOM City project

- 2024: Focused on operational efficiency, reducing operating loss by 30%

Currently, Zigbang is valued at approximately $1.8 billion.

AI Integration and Smart Home Expansion

Post-acquisition of Samsung SDS’s Home IoT division, Zigbang has pivoted into the smart home industry, deploying facial recognition door locks and B2B/B2C smart home solutions, further diversifying its portfolio.

Globalization and Involvement with NEOM

Zigbang is vying for IT infrastructure contracts in Saudi Arabia’s landmark NEOM city project, collaborating with KT and various global tech players. Zigbang’s presentations prioritized smart home services and a virtual model house, showcasing their innovations in smart city infrastructure. Most importantly, this participation signals Zigbang’s ambition for global expansion and leadership in futuristic urban development.

Zigbang vs Traditional Real Estate Agencies in South Korea

Although Zigbang is a platform rather than a traditional real estate agency, the company faces significant challenges navigating the nuanced dynamics between online platforms and offline brokers.

Brokerage Controversy

In 2021, Zigbang’s entry into brokerage services stirred discontent among traditional brokers who perceived it as leveraging advertising fees to undercut them. Therefore, maintaining a balanced relationship with stakeholders in this evolving market remains crucial.

Pros and Cons of Online Platforms and Traditional Agencies

Zigbang’s Strengths

- Vast, searchable listings with extensive photos and virtual tours

- Customized filters and price comparison tools

- Direct communication between users, landlords, and agents

Limitations

- Less personalized guidance, especially for complex property purchases

- Limited face-to-face negotiation and legal support

Traditional Agencies’ Strengths

- Tailored, comprehensive service including valuation, negotiation, and legal assistance

- Deep local market expertise offering neighborhood insights

Limitations

- Smaller inventory pools

- Higher service fees

The Culture of the ‘Budongsan’ in South Korea

In Korea, owning a home is more than just a financial asset—it is deeply woven into cultural values as a symbol of stability, success, and social status. Apartments are especially emblematic, frequently featured in popular culture and representing a milestone of achievement. Real estate constitutes a significant portion of the average Korean household’s assets, underscoring the importance placed on property ownership.

Young Renters and the Need for Affordability

Amid soaring housing prices, many young Koreans face challenges securing affordable homes, particularly in urban centers like Seoul. This younger generation often prioritizes flexibility, budget-conscious living, and convenient access to work and amenities, leading them to seek smaller apartments, studios, or shared housing options over traditional large family homes. Their housing search typically values speed and ease, as many are transient workers or students with limited time and resources.

A National Preference for Convenience and Anonymity

Koreans have a distinct tendency toward valuing convenience and maintaining a degree of anonymity in transactions. Renting through traditional 부동산 (budongsan) often involves face-to-face negotiations with brokers and landlords, which can feel time-consuming or intimidating, especially for younger or first-time renters. This cultural preference fuels demand for streamlined, digital solutions that reduce direct personal interactions but still offer reliable, safe transactions.

How Zigbang Caters to These Needs in South Korea

Zigbang’s platform resonates strongly with this digitally native generation by providing a fast, anonymous, and convenient way to search for housing without visits to multiple real estate offices. Its mobile-friendly interface, detailed listings with photos and virtual tours, as well as direct communication channels empower young renters to explore and secure housing on their terms. By aggregating data and leveraging technology, Zigbang satisfies the Korean desire for effortless transactions while addressing affordability and access. As a result, they are bridging the gap between traditional budongsan culture and modern lifestyle demands.

Our Insight: What Does This Mean for Zigbang?

Zigbang exemplifies how virtual real estate platforms can disrupt traditional brokerage by leveraging technology, data, and user-centric design. Its vast listings, virtual tours, and smart home integrations meet modern renters’ expectations for convenience and efficiency, positioning it well against legacy agencies.

However, Zigbang’s limitations in personalized services, negotiation, and complex transactions highlight the ongoing value of traditional brokers. This is particularly true in a culturally nuanced and heavily regulated market like Korea’s. Coexistence appears not only possible but likely, with platforms digitizing and automating routine processes, while offline agents provide tailored expertise and local knowledge.

Furthermore, Zigbang’s global ambitions, such as engagement in Saudi Arabia’s NEOM project and smart home innovations, demonstrate potential for growth well beyond Korea’s borders. The company’s agile adaptation—balancing technological innovation with stakeholder management—may enable it to remain a formidable player in the evolving real estate landscape.

Frequently Asked Questions

Zigbang offers an extensive, searchable online database with virtual tours and direct communication features, enabling convenient property searches without physical visits. Traditional agents, while offering fewer listings, provide personalized negotiation and legal services.

When Zigbang entered brokerage services, some brokers viewed it as a competitive threat leveraging ad fees. This led to tensions requiring careful stakeholder engagement to maintain collaborative industry relationships.

Zigbang integrated VR home tours, acquired smart home tech assets from Samsung SDS, developed AI-enabled smart door locks, and expanded internationally, including participation in Saudi Arabia’s NEOM city project.

While online platforms excel in efficiency and data access, complexities in property transactions and cultural factors ensure traditional agents remain indispensable for personalized, localized services. Both sectors are set to coexist in a hybrid ecosystem.

As the founder of Blue Whale Insight Inc., I’m committed to uncovering transformative business stories like Zigbang’s that demonstrate how digital innovation meets traditional markets. These insights aim to inspire small and mid-sized companies embracing change, especially across Korea, China, and North America.