Market Kurly: The E-Commerce Giant Slayer

In South Korea, e-commerce rules supreme with one of the fastest and most reliable delivery infrastructures in the world. In fact, it is a speed matched only by their WiFi and 빠리빠리 (bbali-bbali) culture; a primal sense of speed.

Amongst the e-commerce giants tussling for space, two dominant names currently rule South Korea: Coupang and Market Kurly. While Coupang is larger, Market Kurly paved the way for what Korea now sees as standard operating procedure in 2015. In doing so, it set the tone for things to come over the next decade.

The Dawn of Kurly: Innovation and Early Success in South Korea

Founded by ex-investment banker-turned entrepreneur Sophie Kim, Market Kurly revolutionized fresh food delivery in South Korea. As a result, it has evolved from a niche fresh food platform to a diversified high-margin product retailer. What’s more, it recently recorded its first Q1 profit in and has set its sights on a high-stakes IPO.

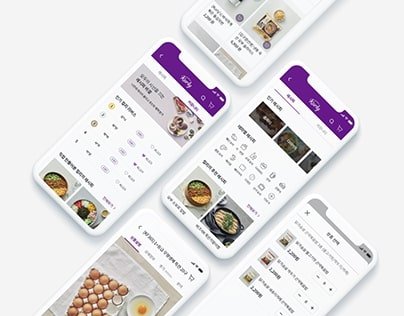

Market Kurly entered the market with a laser focus on quality and logistics innovation. Its signature “Saetbyeol Delivery” – a next-day, early morning delivery service – altered consumer expectations in South Korea long before competitors like Coupang entered this space.

Saetbyeol Delivery: The E-Commerce Game-Changer

Launched in 2015, this dawn delivery system required Kurly to make heavy investments in cold-chain logistics and overnight staffing. It also established a reliable supply chain from carefully selected suppliers to consumers’ doorsteps by 7 a.m the next morning. The ability to deliver fresh groceries overnight helped build a loyal customer base that valued both freshness and convenience.

Key Milestones

- 2015: Market Kurly launch and rapid user growth, fueled by quality produce.

- 2021: Achieved “unicorn” status with valuation exceeding $1 billion.

- 2023: Introduced a low-price paid membership program, Kurly Members, which quickly surpassed 1.6 million subscribers.

- 2024: Made a second attempt at IPO aimed at a $2.3 billion valuation.

- 2025: Recorded its first quarterly profit of 1.76 billion won; expanded into luxury fashion goods via third-party retailers to increase margins.

From The Farmers to Kurly: Mission-Driven Differentiation in South Korea

Market Kurly’s mission from the beginning was clear: to revolutionize food delivery by focusing on quality products and seamless logistics. Therefore, Sophie Kim founded the company on a passion for fresh and healthy food, believing that changing consumer habits toward quality would be key.

Her insight was that consumers shop online only when they can clearly discern superior products. This is a fundamental shift from price-driven purchases to value-driven ones.

“Consumers will get online only when they can discern a good product. This requires a change in habits,” Kim explained in a recent interview with the Korea Economic Daily. “Market Kurly fares better the more people change their minds and become particular about food. If the perception about food does not change, however, that is more advantageous to conventional businesses.”

As a result, this focus on curated, premium goods set Kurly apart in a crowded marketplace dominated by volume and low prices.

The Grass Isn’t Always Greener: Challenges Faced

Like any disruptive startup, Market Kurly faced considerable obstacles in scaling its unique model within a highly competitive and mature e-commerce market.

Competitive E-Commerce Threats

Large players such as Coupang and Emart, along with the looming specter of Amazon, constantly pressured Kurly to innovate. South Korea’s local companies are deeply entrenched, and the marketplace is in constant flux, requiring continuous adaptation.

Scaling Fresh Food Delivery in South Korea

Maintaining quality across perishable goods while expanding geographically was a massive operational hurdle. Kurly had to optimize delivery routes, cold-chain logistics, and inventory management to prevent spoilage and maintain freshness.

Funding and Financial Constraints

Kurly relied on multiple funding rounds – including anchor investments from Anchor PE and others. However, tightening global investment climates and IPO market volatility forced them to postpone public listings multiple times. CEO Sophie Kim underscored the urgency of finally launching an IPO to avoid losing ground.

CEO Sophie Kim unveiled her plan during a senior executive meeting in February. She was cited as saying “we could lag behind in the market if we fail to launch an IPO within the year because the local e-commerce market is reshuffling in favor of big players.”

Slaying the E-Commerce Giants: How Kurly Holds Off Amazon and Others in South Korea

Despite Amazon’s global dominance rooted in rapid delivery and broad product variety, its presence in Korea remains muted. Industry insiders attribute this to Korea’s existing hyper-fast delivery ecosystem – Kurly and local rivals already offer service speeds that rival Amazon’s Rocket Delivery.

Amazon’s South Korea Strategy

Unlike its aggressive push in China and Japan, Amazon has remained cautious in Korea. Instead, it has focused more on recruiting Korean sellers for global sales than direct consumer commerce.

Why Local Players Prevail

Firstly, local startups like Kurly, Coupang, and Ticket Monster succeeded by differentiating with localized marketing tactics. This means understanding Korean consumer habits deeply, and building tailored service models. Other failed e-commerce attempts in Korea (for example Groupon) reinforces the importance of adapting to unique markets rather than transplanting global models.

Not Just Groceries: The Future of Kurly

Kurly’s future growth strategy centers on sustained innovation and product diversification beyond fresh groceries.

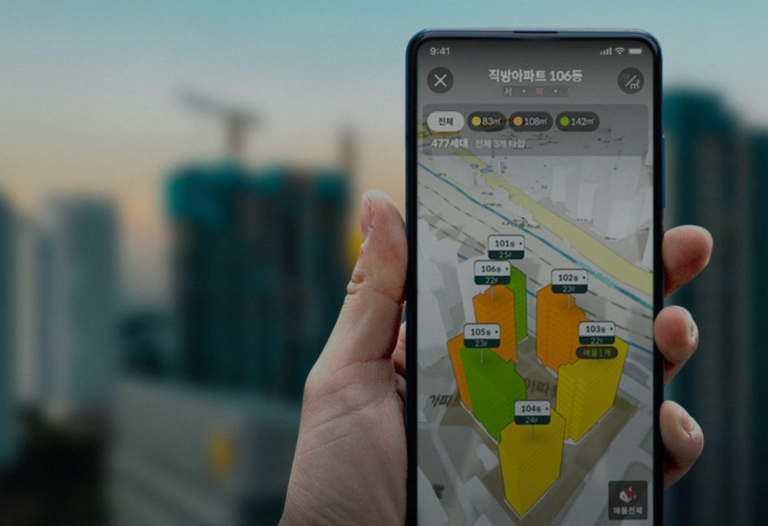

Enhancing AI and Personalization

Leveraging AI, Kurly aims to deliver highly curated, personalized shopping experiences, increasing customer loyalty and repeat purchases.

Geographic Expansion

Kurly plans to extend delivery coverage into suburban and rural areas across South Korea, capturing a broader demographic.

International Market Exploration

Exploratory moves include potential U.S. market entry and flagship stores in Hong Kong and Singapore, testing Kurly’s premium curation in diverse markets.

Diversified Product Lines

Launching luxury fashion and living goods, Kurly seizes higher-margin categories to improve profitability ahead of anticipated IPO. Incorporating third-party sellers of curated luxury items addresses both consumer desires and margin pressures.

Growth Forecast: Solidifying the Turnaround

2024 marked a turning point with Kurly achieving positive EBITDA for the first time (13.7 billion won), signaling operational efficiency improvements. Furthermore, opperating losses shrank drastically, and early 2025 continued the momentum with the first quarterly operating profit reported.

Profitability Concerns

Financial experts remain cautiously optimistic, noting that EBITDA excludes stock compensation costs. Inclusion of such expenses still places Kurly near break-even, suggesting the need for sustained performance to assure investors.

Funding and Valuation

Having secured $631 million total funding across eight rounds, Kurly prides itself on strategic capital management. The latest Series G round at $3.3 billion valuation reflects investor faith but is weighed against wary market sentiment grounded in the company’s history of losses.

Our Insight: Why Market Kurly’s E-Commerce Success in South Korea Matters

Market Kurly’s success is rooted in its relentless focus on quality, operational excellence, and customer-centric innovation. Therefore, it has carved out a profitable niche amidst formidable competitors. Its early leadership in dawn delivery disrupted traditional grocery retail and set new service benchmarks in Korea. Continuous product diversification, coupled with smart membership incentives and logistics upgrades, has enabled Kurly to reach profitability after a decade of investment-heavy growth.

However, sustaining this trajectory requires navigating fierce competition from giants like Coupang and potential entrants like Amazon. Market and funding uncertainties, along with the challenge of scaling freshness and quality, will test Kurly’s agility. For small and mid-sized businesses seeking cross-border growth, Kurly’s story underscores the power of niche specialization. It is a story of customer loyalty, and relentless innovation as keys to surviving and thriving amongst corporate Goliaths.

Frequently Asked Questions (FAQs)

Market Kurly pioneered the dawn delivery model, delivering fresh groceries by 7 a.m. the next day, which was unprecedented in Korea. Additionally, its focus on high-quality, curated products and personalized customer experiences helped distinguish it from competitors focused mainly on price and volume.

Korea already has one of the world’s fastest and most efficient delivery systems, with local players deeply attuned to customer preferences. Amazon’s global model without strong localization efforts or acquisitions has not resonated well in the saturated Korean market.

Kurly must demonstrate sustained profitability and growth to justify its $2.3 billion to $3.3 billion valuation amidst market skepticism and volatile stock conditions. Delayed IPOs have eroded some investor confidence, raising the stakes for Kurly’s performance.

Kurly intends to expand geographically, enhance AI-driven personalized shopping experiences, explore international markets, and diversify into luxury fashion and living goods with higher margins to sustain financial health and competitive advantage.

Author’s Note: As founder of Blue Whale Insight Inc., I am passionate about sharing inspiring startup journeys like Market Kurly’s to highlight how small and mid-sized businesses can innovate and thrive on the global stage. Stay tuned for more weekly insights on dynamic startups reshaping markets across Korea, China, and North America.